Back to Top ↑

ISQ - October 2024

A series of unprecedented and historic events have completely shifted the candidates and dynamics of the race for the presidency and Congress—yet the key issues and likely market impacts of the race remain largely the same, following the entry of Vice President Kamala Harris as the Democratic challenger to former President Donald Trump. Despite a notable shift in sentiment and momentum behind Harris (compared to when Biden was the nominee) the race is likely to be close through Election Day. Given this unpredictability, we caution against viewing individual incremental shifts in either direction (especially in polling) as clear evidence that either candidate is headed to victory. On the policy/financial markets front, while both Trump and Harris have offered some previews of their respective agendas, policy specifics will still need to be filled in, including monitoring who is selected for key roles in either Administration. Control of Congress will also play a key role in the ability of either candidate to enact his or her agenda. Republicans have a clear advantage in the Senate and Democrats have a slight advantage in the House, but a sweep by either Party remains a very real possibility—adding additional uncertainty to the 2025 agenda and market reaction. From now until November, we will be watching for a series of known factors (including longer-term momentum in polling trends and favourability statistics) and unknown factors—for example, whether the wave of momentum shifts behind either candidate heading into November, or whether the race definitively becomes framed as a referendum on one or the other leading protagonists.

The biggest change in the race (aside from the nominees) has been the resurgence of momentum and enthusiasm within the Democratic base.

The biggest change in the race (aside from the nominees) has been the resurgence of momentum and enthusiasm within the Democratic base, compared to when President Biden was the nominee. While expectations of a 2020 rematch dominated much of the election conversation in Washington DC in the past year, we have consistently highlighted the possibility of unexpected events upending the race.

Those unexpected events have since occurred in spades, with the poor performance by President Joe Biden at the June presidential debate kicking off the series of events that led to his historic withdrawal from the Democratic nomination and Harris’ rapid ascent to the top of the ticket. Harris’ clinching of the nomination was met by a material uptick in Democratic voter enthusiasm—with likely down-ballot impacts—as well as fundraising dollars and polling numbers. This will be especially impactful in House races in New York and California, where there are eight Republican House members in races that are rated as ‘toss-up.’ While New York and California are unlikely to be competitive at the presidential level, higher turnout among Democrats could be decisive in these House races and potentially determine the outcome of the House majority.

To win the presidency, a candidate needs to secure 270 Electoral College votes and the structure of the Electoral College favours Republicans. As in recent presidential elections, a small set of voters in a handful of swing states are likely to determine the outcome of the 2024 presidential election. Pennsylvania is emerging as a potential tipping state, with the candidate who wins Pennsylvania having the likeliest path towards the 270 Electoral College votes necessary to win the presidency.

A key metric we follow in presidential elections is favourability ratings – something we frequently highlighted as a significant warning sign of the re-election bid of President Biden. The favourability rating can be a proxy for an individual’s willingness to vote for a candidate. In 2016 and 2020 each presidential candidate had a net-negative favourability rating, which led to a discussion as to who can win votes, despite a negative perception. We will be monitoring the favourable/ unfavourable ratings of each candidate to see if it provides insight into who can win over a majority of undecided voters.

It does not change the reality as to what the race is likely to come down to: a small set of voters in key swing states (especially Pennsylvania).

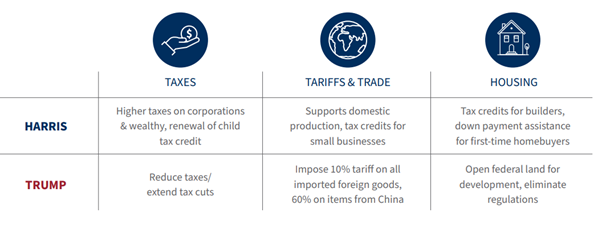

The market impacts of the range of electoral outcomes have also not changed on a fundamental level. We largely view Harris’ policy platform as an extension of Biden’s on key issues including trade (where we would expect a continuation of the current targeted tariff approach) and tax, where we would likely see a push to raise the corporate rate and potentially allow the individual provisions of the 2017 individual tax changes to expire. While we have got some additional clarity as to Harris’ specific policy priorities with regard to the cost of living and taxation, the lack of a traditional nominating process reduces the amount of specific policy details.

Recent calls from Trump for a 60% tariff on all Chinese goods and a 10-20% global tariff are a key examples of a key dynamic to consider when assessing the market impact of a potential second Trump term: these policy proposals should be taken seriously, but not literally. Our conversations with Washington contacts reaffirm our expectation that while a Trump victory would likely bring changes to impactful policy areas including tax, immigration, tariffs and geopolitics, the specifics are not set in stone—and influenced by who is appointed to key roles. The changes in regulation would also be a notable change in a second Trump term compared to the Biden Administration. Equities in heavily regulated industries could see a positive sentiment shift following the election, but we always advise that the regulatory environment is only one of many factors to consider when making investment decisions.

As we enter the final stretch of the 2024 election, the race between Harris and Trump remains highly competitive, and there are compelling arguments that either candidate could win. Arguments in favour of Trump include his strong base of support, the Republican advantage in the Electoral College, and historical polling misses that have underestimated his support. Conversely, there are concerns about stalled momentum, poor favourability ratings and a ‘low ceiling’ (46% in 2016 and 47% in 2020) with voters in the previous elections.

There are compelling arguments that either candidate could win.

For Harris, she has seen enthusiasm within the Democratic base, has achieved record-breaking fundraising numbers, has polling momentum compared to Biden’s performance, and dramatically increased her favourability rating. However, we would also highlight the structural disadvantage for Democrats in the Electoral College, in addition to previous polling misses overcounting Democratic support. Importantly, only one sitting vice president (George H.W. Bush in 1988) has been elected president in the last 188 years.

With weeks left until Election Day, both candidates are intensifying their efforts to sway undecided voters and energize their bases. In the remaining weeks and with the above arguments in mind, we are watching several key factors that could shape the final result of a very tight race, including how the race is framed in the media, performance in battleground states, polling, voter turnout and campaign spending.

The election will likely be decided in seven key swing states: Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin. In addition to these seven states, swing districts in Nebraska and Maine, which award single Electoral College votes, will also receive significant attention. Increasingly Pennsylvania is looking like the key state where a win for either side would make it very difficult for the other candidate to capture the necessary 270 electoral college votes necessary to win the presidency. One important note about Pennsylvania is a law that forbids opening mail-in ballots until 7 p.m. on election day. Like 2020, a close election in PA could take days to clearly identify a winner.

We receive many questions about polls. While they can be a useful tool to get a general sense of the direction of a political contest, we recognize their limitations. In 2016 and again in 2020 public polls undercounted the final strength of Donald Trump at the national and swing state level. In 2016 polls under-reported the final vote total for Donald Trump by 3.43% and 2.28% in the swing states. Polling errors can occur in either direction, with the 2012 election undercounting the strength of Barack Obama by 1.43%. The closer the final polling data, the greater the probability of another surprise on Election Day.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this article is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this article should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this article have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this article please contact your wealth manager.

APPROVED FOR CLIENT USE