Back to Top ↑

ISQ - April 2021

Key Takeaways

Energy transition is a megatrend not just for the next few years but toward the middle of the century.

A dozen of the top-tier oil and gas producers have committed to reorient their operations toward low-carbon energy over the next 20 to 30 years. They are doing it because they view it as good business.

Sustainable (ESG) investing – and, more specifically, climate investing – is raising the importance of energy transition for management teams, particularly at publicly-traded companies.

Technological change is creating economic incentives for self-motivated decarbonisation. Case in point: more than 280 large companies around the world, encompassing nearly every industry, have committed to source 100% of their electricity from renewable sources — and many have already achieved this target. Even more impactful, a dozen of the top-tier oil and gas producers have committed to reorient their operations toward low-carbon energy over the next 20 to 30 years. To clarify, these companies are doing it not because they are forced to by governments, but rather because they see it as good business. For example, the past decade’s massive reductions in wind turbine and solar hardware costs mean that in-house wind and solar farms routinely provide lower-cost electricity for data centers as compared to buying power from the grid – and, amid frequent headlines about weather-related power outages, integrating such assets with batteries can also provide 24/7 reliability. Bus and truck fleets converting to electric or fuel cell vehicles stand to achieve savings on fuel as well as maintenance, which offsets the higher upfront cost of these vehicles. Similarly, upgrading buildings with energy-efficient windows, LED lighting, and energy management software also pays for itself over time

More than 280 large companies around the world, encompassing nearly every industry, have committed to source 100% of their electricity from renewable sources.

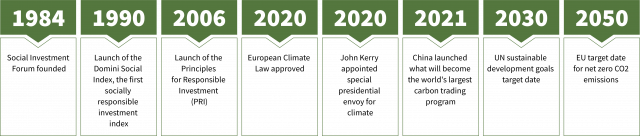

On the policy front, there are some specific milestones that we are tracking in 2021. In December 2020, the European Union approved the European Climate Law, thereby becoming the world’s largest carbon emitter to impose a legally binding mandate for net zero CO2 emissions by 2050. As the details of the implementation roadmap are unveiled over time, the entire European economy will need to be transformed — not solely the ‘usual suspects’ (power plants and transport). The UK is no longer an EU member, but it has had equivalent legislation since 2019. In the run-up to the United Nations climate conference this November, more countries will set net zero targets — China, Japan, and South Africa have already signaled plans to do so — though the details are more important than the headlines. President Biden has proposed the same policy for the US, as well as a 100% carbon-free electricity mandate by 2035 and $2 trillion of federal spending on energy transition over four years. We are not confident that any of this can get through the narrowly divided House, and the 50/50 Senate looms as an especially tough hurdle. Thus, we will be watching how the Biden administration uses executive action (e.g., fuel economy standards, oil and gas permitting rules, and tariff policy) to incrementally boost decarbonisation, as well as what happens at the state level. Much like in the US, many other jurisdictions around the world are not yet ready to enact sweeping climate reforms but still have some targeted policies, such as a coal phase-out, a carbon tax, a renewable electricity or fuel mandate, or an energy audit requirement for buildings. Contrary to conventional wisdom that only high-income countries have the ‘luxury’ to approve such policies, in reality there are plenty of emerging markets that are active in energy transition – most notably China, which in January 2021 launched what will eventually become the world’s largest carbon trading program.

Alongside the fundamental drivers mentioned above, sustainable (ESG) investing — and, more specifically, climate investing — is raising the importance of energy transition for management teams, particularly at publicly-traded companies. Broadly speaking, there are two approaches to climate investing, and these are not mutually exclusive. First, investors can exclude those companies that are having a disproportionately negative effect on the climate. Second, they can favour those companies that are creating beneficial climate-oriented solutions. Here are the key statistics vis-à-vis ESG: as of 2020, $16.6 trillion of professionally-managed assets (equity and debt combined) in the US are covered by one or more ESG criteria, up 56% from 2018. Remarkably, this represents fully one-third of all managed assets. Within the $16.6 trillion pie, the largest single slice — climate funds — accounts for $4.2 trillion. Meanwhile, the worldwide total of funds with a fossil fuel divestment policy is approaching $20 trillion, though the vast majority of the divestments pertain solely to coal, at least for now. Divestments are more common in Europe than elsewhere, and more common among universities and foundations than traditional asset management firms. Looking at debt specifically, green bonds are a popular way to raise capital for projects with a positive climate impact, including below-the-radar projects such as reforestation, public transit, or making the electric grid more resilient.

Investing in energy transition does not need to be limited to high-beta, high-multiple stocks of solar, electric vehicle, or hydrogen companies (which is what tends to come to mind first). Certainly there are plenty of options in the clean tech sector – the aggregate market cap is approximately $1.5 trillion, the highest ever – but businesses in many other sectors are also playing a role. For example, some banks and insurers are more active than others in boosting lending to renewable energy initiatives and/or cutting back on lending to fossil fuels. Alongside the well-known electric vehicle (EV) pure-plays, just about every major automaker has EV models available, and some have committed to becoming exclusively electric over the long run. Food, beverage, and other consumer goods companies are taking steps to reduce single-use plastics, which sometimes involves partnering with startups developing bio-based chemicals. REITs and homebuilders are deploying energy-efficient technologies across their asset base. The bottom line is that investors ought to be creative, rather than only looking at the well-known high-flyers.

Sustainable (ESG) Investing considers qualitative environmental, social and corporate governance criteria, which may be subjective in nature. There are additional risks involved, including limited diversification and the potential for increased volatility. There is no guarantee that these products or strategies will produce returns similar to traditional investments. Because criteria exclude certain securities/products for non-financial reasons, investors may forego some market opportunities available to those who do not use these criteria.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE