Back to Top ↑

ISQ - April 2021

Key Takeaways

The U.K. economy in 2020 saw its biggest contraction in over three centuries.

Whilst corporation and personal taxation rates are rising, other benefits are helping.

Brexit issues can still impact the economy but the threat of any global trade wars are low.

U.K. reopening is likely to help boost economic profiles – and the stock market – this year.

To live without hope is to cease to live

Ian Bremmer

Classically, economic growth is determined by a combination of consumer spending, investment levels, overall net government initiatives and global trade opportunities. Despite the introduction by the U.K. government of significantly widespread furlough schemes, consumer spending, corporate investment levels and global trade levels all fell significantly. Unsurprisingly a U.K. economy which is progressively moving significantly away from a period of lockdown will naturally progress. However – sadly – no period of significant economic support can be achieved without major cost. And this starts with U.K. debt levels.

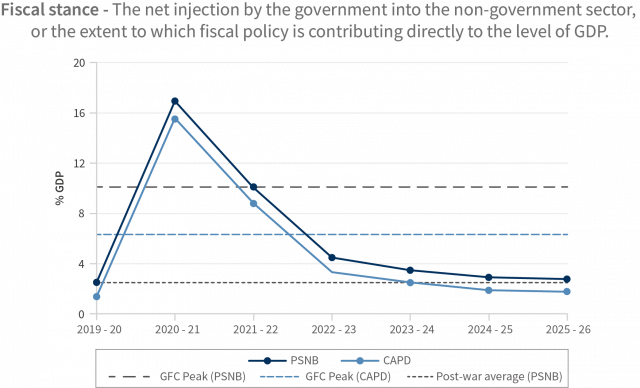

Whilst we continue to experience extremely low interest rates combined with significant amounts of Bank of England stimulus, a significant heightening of national debt levels is a short, medium and longer-term problem. Current government borrowing levels are anticipated to reaches nearly seventeen percent of GDP in the financial year at the end of March 2021, the highest level of peacetime borrowing on record. Unsurprisingly whilst there have been some indications of higher mainstream business tax rates later on this decade, these levels still remain relatively light compared to many other countries around the world. Additionally a new policy initiative to try to encourage business investment expenditure is a positive effort, as this should encourage both corporate growth as well as new job employment. And whilst the freezing of personal taxation levels will mean anyone with a gain in their wages will pay more tax, the change is currently anticipated to be relatively moderate. In short, whilst the raised debt levels do mean that higher tax levels will occur over upcoming years the increase is not yet too dramatic and is unlikely alone to significantly hold back U.K. growth recovery.

Whilst the raised debt levels do mean that higher tax levels will occur over upcoming years the increase is not yet too dramatic and is unlikely alone to significantly hold back U.K. growth recovery.

But how about global trade opportunities? Undoubtedly impacts from differing levels of COVID-19 vaccination progress will have some impacts on both export and important trends, but still the most important issue for upcoming years remains centred on Brexit. The forging of a deal just before Christmas last year was a positive move with the part of the world which will continue to generate the most trade opportunities for the U.K. for the foreseeable future. Whilst there are still some practical uncertainties, economy-wide impacts are unlikely to be extremely negative for the 2020s assuming trade wars can be avoided (a likely scenario even with China).

And finally, we are back to the consumer. With unemployment levels now expected to peak more rapidly than anticipated last year, hopes for significant progress in consumer spending levels – assuming continued opening up of the U.K. economy – will also positively impact the U.K. financial markets.

Globally there is always the potential for uncertainties centred on excessive optimism, too much debt, diplomatic challenges, and unanticipated weather or earthquake effects. For the markets over time the most challenges later this decade will come from the rapid increase in global debt levels. But this – in all likelihood – is something for 2022 and beyond and not for this year, which will give governments and central banks around the world further time to find more solutions for the rest of the 2020s. Meanwhile for this year, the outlook for 2021 – on balance – still suggests further improvement. And the U.K. – after its economic difficulties last year – is set to bounce back well over the rest of this year and into 2022.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE