Back to Top ↑

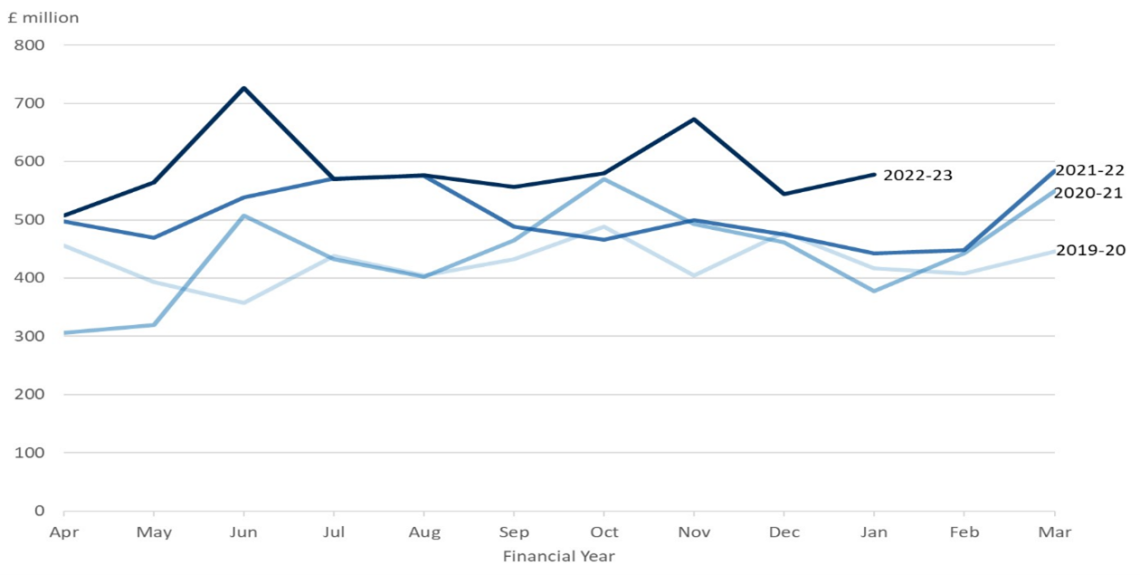

The government collected £6.1bn in Inheritance Tax (IHT) bills for the 2021-2022 financial year – a 14% increase on the year before. With the banding frozen until 2028 following the 2022 Autumn budget, this will only continue to move upwards.

HMRC Monthly Receipts

According to the Office for Budget Responsibility, the tax revenues will rise to £8.3bn by 2026.

The Chancellor, Jeremy Hunt, announced that IHT, which is charged at 40% of a person’s estate above the tax-free allowance (also known as the nil-rate band) of £325,000, will be frozen until 2028. This had already been frozen until April 2026 by Rishi Sunak when he was Chancellor. It is now nearly fourteen years since there was a change to the core IHT allowance, having remained at the same level since 2009.

The Residence Nil Rate Band (RNRB) of £175,000 may be available (in addition to the NRB) if you are passing your main residence to a direct descendent, such as a child or grandchild. The RNRB is reduced on estates worth over £2million and tapers by £1 for every £2 of value by which an estate exceeds the taper threshold. If the RNRB has not been fully used on the estate of the first to die of a married couple or civil partnership the unused part can be transferred to the second estate.

Below are seven ways that can help you minimise your Inheritance Tax bill

Around one in twenty-five deaths results in an IHT liability, according to pension provider AJ Bell. Early planning can help reduce or remove this potential tax charged at 40%.

Please note these are simplified examples of what can be done and if they are of interest, you are best advised to seek professional advice.

1. Make a Will

Start by making a Will. If an individual passes away without a valid Will, their estate will be distributed following a specific set of guidelines which could in turn generate more of an Inheritance Tax liability, leaving less of the estate to loved ones.

2. Take advantage of gift allowances

This can be the easiest way to pass your assets onto your loved ones without paying tax. But there are some things to consider.

There is no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime if they:

• live in the UK permanently

• are legally married or in a civil partnership with you

There is also no Inheritance Tax to pay on any gifts you give to political parties.

Anyone can give up to £3,000 of their assets or cash each tax year without the amount becoming liable for IHT, no matter when they die. If unused, it may be backdated one year to total £6,000.

Gifts of £5,000 to children made in advance of a wedding are also protected from IHT; for Grandchildren this amount is lower at £2,500. This may be on top of your annual £3,000 exemption. You can also make unlimited wedding gifts of £1,000 to any non-related person each tax year.

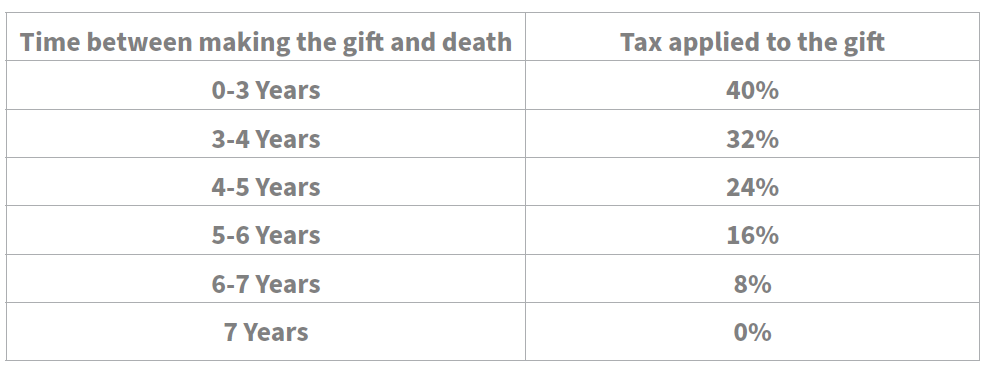

But, if you die within seven years of making a gift in excess of your nil-rate band of £325,000, IHT will be payable on a sliding scale as shown below:

Another option is for a gift to be exempt as a gift out of surplus income, however the following conditions must be satisfied:

• The gift must be part of your normal (i.e typical or habitual) expenditure; and

• The gift must be made out of your after tax income taking one year with another; and

• After allowing for all other transfers of value forming part of your expenditure, you are left with sufficient income, in order to maintain your usual standard of living.

In order to satisfy that the gifts were part of your normal expenditure, it will be necessary to show a commitment to make regular gifts as part of a settled pattern of giving.

3. Put it in a pension

The main purpose of a pension is to provide you with income in retirement. But you can also nominate beneficiaries should you pass away before you receive it. The nominations must be submitted directly to your pension provider, and generally IHT is not payable.

If you die after the age of seventyfive your beneficiaries will need to pay income tax on the money they take out of the pension. The rate depends on whether they are a basic (20%), higher (40%), or additional rate (45%) taxpayer.

4. Invest in AIM (Alternative Investment Market) shares

AIM is a sub-market of the London Stock Exchange which allows investors access to smaller companies.

Investing in qualifying AIM shares have IHT benefits, since many stocks on London’s junior stock market can qualify for Business Relief. However not all AIM shares qualify (as approved by HMRC) and you must hold the shares for at least two years to be exempt from IHT. They also need to continue to be qualifying upon death. AIM companies are smaller, less established companies and share prices can be volatile.

The UK Government’s decision in 2013 to allow AIM-listed shares to be held within Individual Savings

Accounts (ISAs) means that investors can now hold BR-qualifying shares within a tax-efficient ISA wrapper.

5. Set up a trust

Setting up a trust to hold your assets could be another option to consider.

The trustees control the assets, rather than them being passed onto the beneficiaries right away. This may be useful if you are concerned about gifting assets to a loved one who is perhaps not renowned for their financial prudence, or perhaps to minors.

Important to note that trusts can be expensive to run and subject to tax charges, which together with their complexity makes them worthwhile in only a few circumstances.

6. Take out an insurance policy

You may purchase an insurance policy that covers IHT liability, these are generally written in trust.

This route offers you peace of mind, that your beneficiaries will not struggle with a huge Inheritance Tax bill when you die. You are effectively paying at least part of that bill while you are alive through your monthly premiums, which can sometimes be substantial. As you might expect, the older you get the higher the premium. Though this will vary depending on your underlying health.

7. Donate to charity

If you leave any part of your estate to charity you receive a proportionate deduction on your IHT rate.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

With investing, your capital is at risk. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation.

Raymond James Investment Services Limited is a member of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3779657. Registered office Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY. Information correct as of 23 March 2023