Back to Top ↑

ISQ - January 2023

Economic history is replete with semantics regarding economic contractions. The Panic of the 1930s was euphemistically relabelled ‘the Great Depression’ by the Hoover administration, economic slowdowns became ‘recessions’ during the Carter administration and came full circle with the Global Financial ‘Crisis’ (also known as the Great Recession) of 2008. The Biden administration may be searching for yet another descriptor with an economic and earnings slowdown on the horizon.

Perhaps ‘reorder’ might fit the bill? The global economic and policy landscape has undergone seismic shifts during the past three years. Pandemics, like famine and war, have structural after-effects that flow through society, the economy, and markets long after the immediate impacts abate. Inflation, a biproduct of turbo-charged fiscal and monetary policy responses, is the market death knell of boundless post-financial crisis liquidity. Inflation has surged to the highest level in decades and remains the most regressive tax on economies. Everyone pays for higher inflation and as a result, consumer spending power has fallen more than in any year since 1995. Policymakers’ misjudgement of the inertia behind inflation has global central banks playing catchup. However, market observers are treating this period as a phenomenon within the normal business cycle—or in other words, ‘transitory.’

The backdrop for better long-term outcomes may be improving dramatically.

Consensus maintains that a probable U.S. (and global) recession will be ‘short and shallow’, certainly so in the context of the recent past and inflation will return to its 2% long-run average. In short, the post-COVID-19 economy will look like the pre-COVID economy. This view misses key structural changes likely to be long-lasting and influential to capital markets and investment returns. Longer-term inflation will likely remain much higher than 2%. U.S. CPI has come in below estimates only three times in the past 21 months. Headline CPI began the year at 7.0% year-over-year (YoY) and will finish the year persistently above 7.0% YoY once again, a very similar picture to that across developed economies more generally, suggesting the Fed and other systemic global central banks must get and stay restrictive for longer. Peaking inflation is not as significant as the terminal rate of inflation being a long way from the 2% target.

A Fed ‘pivot’ is not likely until core inflation falls below 4% or the labour market suffers significant strain. The evolution of the labour market will be crucial in the U.K. too. The policy of throwing liquidity at market volatility or economic weakness is no longer available. Senior global central bankers hope for, and are orchestrating, a slowdown. For markets reactive to any prospect of slowing tightening, pivot, or easing, a non-recessionary period may prove challenging.

The secular changes most likely to impact markets and the economy are the shift from globalisation to on-shoring or near-shoring, the end of cheap and plentiful capital, and unsettled labour markets. The United States, once a champion of free trade, has become more protectionist. Supply chains are disrupted, and ‘just in time’ gives way to ‘just in case’. Borrowing costs have increased sharply on more than one-third of global debt (previ-ously negative yielding), and credit conditions are tightening.

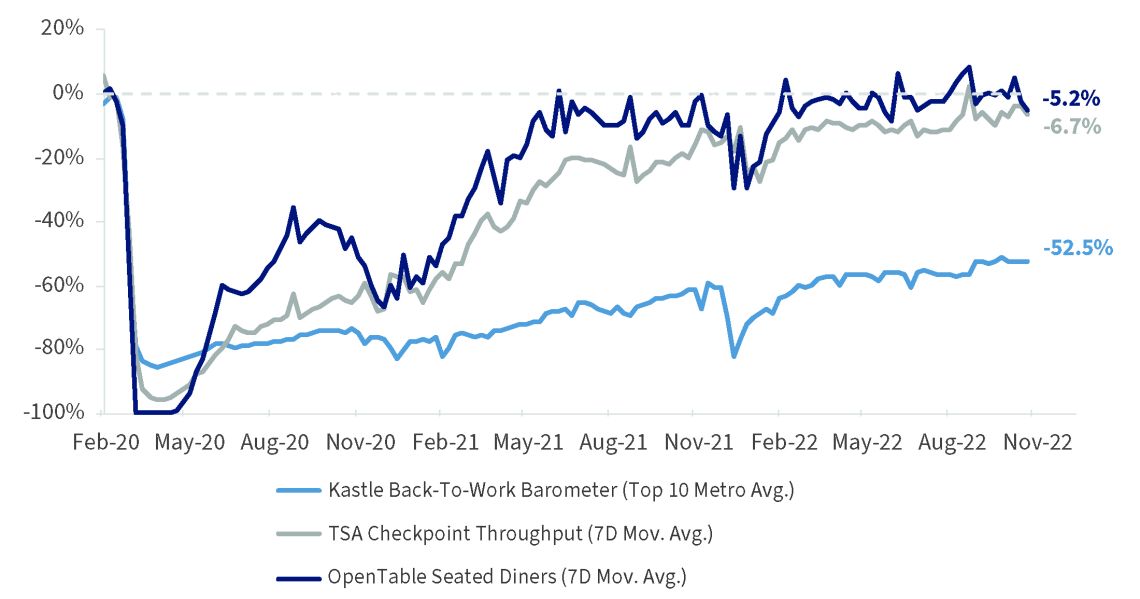

Mortgage rates have spiked, and the housing markets (on both sides of the Atlantic Ocean) are already flirting with a recession. Certain parts of the population have exited the labour force, either by choice or necessity. Return to office metrics are hovering at 50% of pre-pandemic levels, even though economic mobility data show back to normal in travel, restaurants, etc. Almost three years after COVID-19 hit, companies are still struggling to get and retain talent. Labour shortages driven by a shrinking pool of workers are a result of population and immigration changes, but also changes in attitudes and preferences. More than ever, businesses need to be strategic in human resource management.

The starting point for employment is historically strong. Jobless rates for developed countries are the lowest since the early 1980s. But developed economy central banks, at least for now, appear willing to sacrifice employment for price stability. White-collar industries such as technology, banking, and real estate, where staffing is above pre-COVID levels, are vulnerable. It will take time to ‘reorder’ that part of the labour force to industries in need of workers.

We’re returning to normal, but not to the office.

“We have moved from bond and stock markets driven by liquidity to markets that are now driven by fundamentals—ultimately a better, more stable model for growth and wealth creation.”

The two primary inputs of the economy, labour and capital, have been transformed. Near-term economic challenges are plentiful, but the backdrop for better long-term outcomes may be improving dramatically. There is growing evidence that companies are adapting to these challenges. A significant uptrend in capital expenditures along with an enduring, positive trend of investment in intellectual property products bodes well for pro-ductivity gains going forward.

Digital expenditures (robotics and the like) have grown by double digits over the past year. Companies embracing and optimising the realities of the hybrid work model can gain a competitive advantage in a tight labour market.

The era of financial engineering is over. The successful businesses in this new regime will be those with efficiency in the deployment of labour and capital. The reset of the bond and equity markets sets the stage for capital allocations based on fundamentals, not speculation. The destruction of trillions in capital in instruments like crypto exchanges and non-fungible tokens (NFTs) marks an important inflection point in the capital allocation process based on easy money.

The financial press may come to remember 2022 capital market returns as an epitaph for balanced investing. During such regime shifts, correlations across asset classes are high. In the U.S., by way of far from exclusive example, a portfolio consisting of the S&P 500 and the 10-year U.S. Treasury note suffered losses of around 15%; however, a portfolio consisting of intermediate investment-grade bonds and quality dividend stocks was down less than 10%. More importantly, the ‘income’ component of the income investing landscape has markedly improved with yields on bonds at decade highs and dividend style factors outperforming. Dividend growth—growth at reasonable prices—will continue to outperform the broader equity markets. Balance sheet quality, management, capital deployment, and labour policies will be factors underpinning performance in the post-COVID economy. We have moved from bond and stock markets driven by liquidity to markets that are now driven by fundamentals—ultimately a better, more stable model for growth and wealth creation.

For fixed-income investors, the worst is over. Historic mark-to-market losses on individual bonds should slowly recover as upward pressure on long-term rates slows and reinvestment begins to capture higher yield levels. It is noteworthy that bond prices have been largely driven by interest rates and liquidity, not credit events. The U.K. pension sector dodged a bullet in this respect over the autumn as economic orthodoxy returned after a distinct wobble. Liquidity issues (due to continual selling from passive vehicles) are more pronounced in the U.S. municipal market, which resulted in long-term municipal yield ratios capturing 85% of the yield of U.S. Treasuries versus 65% at year end 2021. This higher ratio made municipals more attractive, and combined with generally falling yields, they posted their best monthly performance in November since 1986.

The economy and capital markets may recede for a period, but the resilience and ‘reordering’ of the economy sets the foundation for a more productive economy and capital markets in better balance.

*An affiliate of Raymond James & Associates, Inc., and Raymond James Financial Services, Inc.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE