Key Takeaways

Partially due to government fiscal responses to the COVID-19 pandemic challenge, global debt levels are growing.

Global quantitative easing has contributed to very low bond yields in most major economies.

The first and best response to public debt is to grow and innovate, as seen in the post World War Two years. This should be a key global government focus over coming years.

Defaults and inflation are unsurprisingly more troublesome policy options.

‘Rather go to bed without dinner than to rise in debt”

Benjamin Franklin

And yet global sovereign bond yields typically remain exceptionally muted. Looking at benchmark ten-year government paper, for major developed market economies only Italy and South Korea yield over 1% (and in both cases only modestly so). Germany, France and the Netherlands will even offer you a negative yield. And all these numbers in real terms after inflation are even lower.

As every mortgage borrower knows, the rate of interest charged on debt does matter. Looking at the above, there appears to be an almost riskless payoff for borrowing more money. However, just when you think it is safe to go back into the water…

The first key for the maintenance of this strange backdrop is global quantitative easing by the world’s major central banks. Drawing on the laws of supply and demand, if a big player such as a central bank keeps on printing money to buy government bonds, the scope for bond yields to get chased down can be apparent. Certainly, the world of the last eleven years has seen plenty of evidence of this.

As it happens, compressed bond yields via quantitative easing purchasing go back much further than this. Japan has been an unusual fixed income market over more than twenty years. Not only has there been a deep and regular flow sourced from the high savings rates of the local populace but government direct participation in the fixed income markets has frequently seized up the Japanese government bond market. Volatility for practitioners has been remarkably low but there has been liquidity trade-offs. And in such a world the reliance on that regular flow of savings is important, otherwise, the risk is an ultimate lack of central bank credibility including potential inflationary consequences. My instinct is that Japanification is not as easy as it sounds for countries in Europe and the Americas, let alone what it implies for the economic growth backdrop.

Benjamin Franklin’s instincts are undoubtedly correct in a binary choice but in practical policy terms there are three broad policy initiatives a government can enact to counter a build-up in their public debt burden – and these have not changed since classical times.

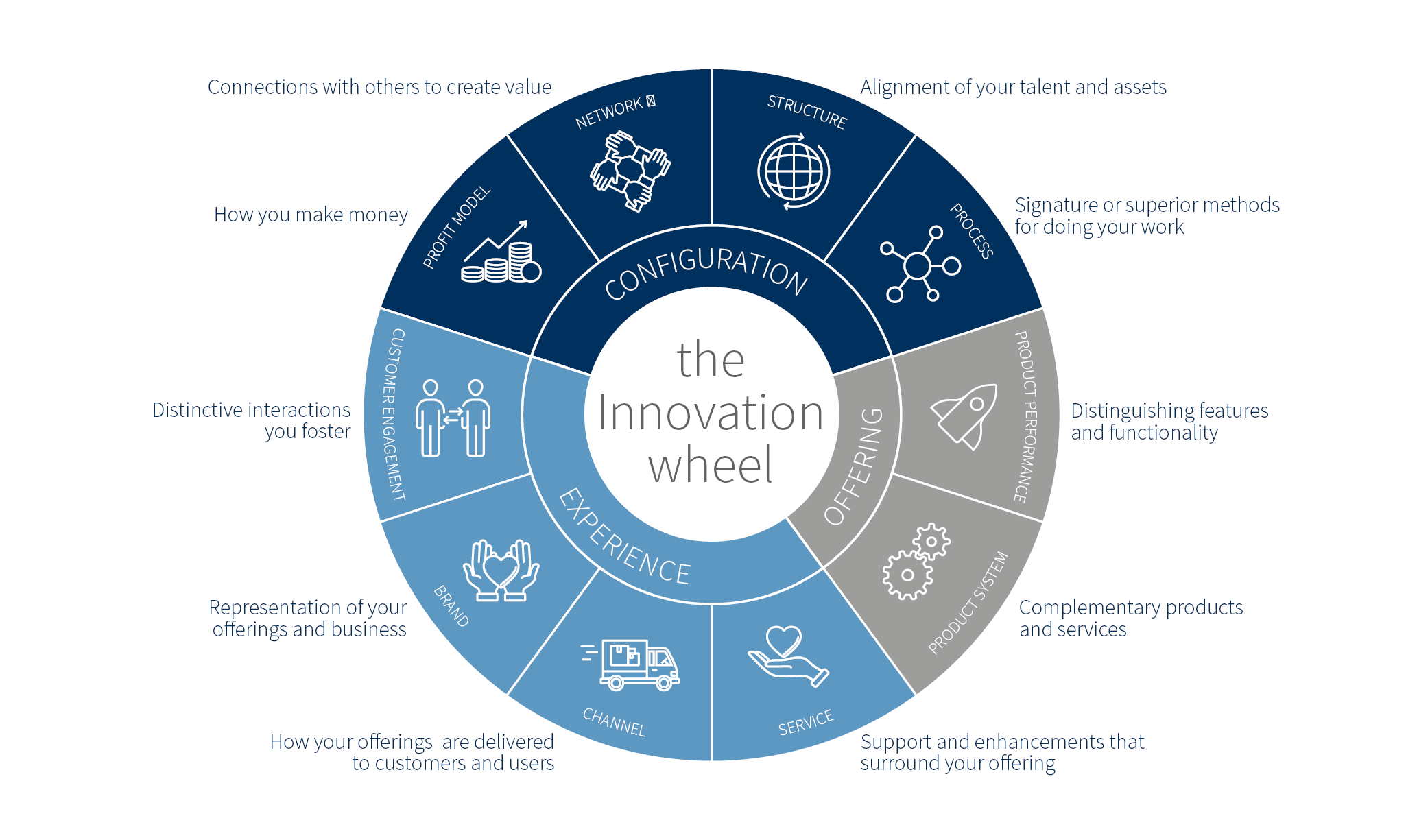

The first and best response to public debt is to grow and innovate. This is what happened after the Second World War, when debt levels in the U.K. were notably higher than even today’s 100 per cent of GDP. Simply put, growing GDP proportionately faster than the at-the-margin interest burden proportional increase will contract debt over time. And whilst much analysis in economic history has been focused on the factors of production (land, labour, capital and entrepreneurial nous), the reality in today’s complex and competitive world is that it centres on innovation. Boost innovative capabilities and hence economic growth to reduce your debt burden. This is after all one reason why China has such a large focus on supply-side change and evolution. A degree of fiscal prudence is required too as the Benjamin Franklin quote attests but – as the old business saying goes – you cannot cut your way to success. Slower growth countries in southern Europe such as Italy and Greece may be enjoying the lower yields on their material debt burdens today thanks to material European Central Bank quantitative easing support, but it is no ultimate solution.

Greece provides a nice segue into another policy option: default. In today’s world this typically evolves into a bond ‘haircut’ (a reduction or maturity extension of anticipated coupon or principal repayments) and certainly a wide range of Greek bond holders faced such a reality a few years ago at the height of the country’s debt struggles. Unsurprisingly, it is a policy to only use in extreme circumstances as even with central bank support, lenders can have long memories. The growth contractions associated with the COVID-19 pandemic are already materially impacting parts of both the corporate and sovereign bond markets in areas (respectively) such as the energy sector and frontier emerging markets. A little bit of credit analytical work can go a long way in today’s world.

And finally, we have the middle ground option to a backdrop of debt which is inflation. A fixed principal investment such as a bond, even with high interest coupon payments attached, is clearly susceptible to inflation and governments throughout time have attempted to counter debt burdens this way. Certainly a world of extensive central bank balance sheet expansion holds a future inflationary threat… if the velocity of money ever tips back up again.

There are very few panaceas in economic and political life. Extended fiscal deficits are an appropriate pandemic policy response, but if uncontrolled they are likely to overwhelm even a currently becalmed fixed income market. Almost no economies in the world today could cope with materially higher bond yields and hence policy choices should be focused on restoring economy-wide growth and innovation efforts. As the world found out in the generation or three after 1945, it can make an awful lot of sense.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE