ISQ - January 2025

Key Takeaways

While the results of the election in November resolved some uncertainties, it opened the door to others which could affect the prospects for economic growth, inflation, and interest rates going forward.

Economic growth continues to be on a strong footing, helped by the very strong tailwinds created by the fiscal expansion provided by the CHIPS, IRA, and Infrastructure Acts as well as by a weakening but still relatively strong employment environment.

Inflation has, finally, approached the Fed’s target of 2.0%.

Economic growth as well as inflation will determine the path of interest rates going forward.

The results of the presidential election as well as those of the US Congress, with a Republican sweep, ended months of uncertainty regarding the next few years. Since then, markets have been salivating at the prospect of a more benevolent regulatory environment vis-à-vis the Democratic alternative. At the same time, markets seem to have become very positive on the prospects of a unified government that should, potentially, take some of the typical uncertainties off the table, i.e., a non-contested extension of the debt ceiling, etc. Having more certainty is great for markets. Still, the Republican sweep opens other uncertainty avenues that could affect the prospects for economic growth, inflation, and interest rates going forward.

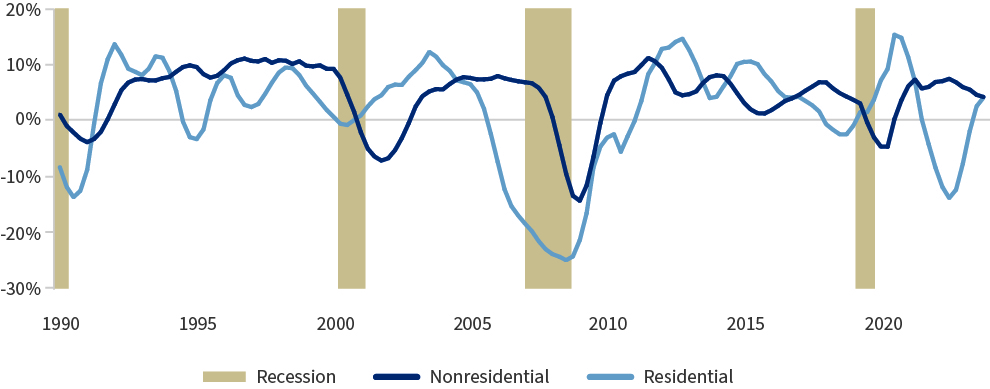

As has been the case for the last several years, economic growth continues to be on a strong footing, helped lately by very strong tailwinds created by the fiscal expansion provided by the CHIPS, IRA, and Infrastructure Acts as well as by a weakening but still relatively strong employment environment. Furthermore, the last several years have shown that, while important, the manufacturing sector’s weakness should not prevent the US economy from continuing to show economic strength. Perhaps the only caveat to our previous argument is that both the CHIPS and IRA legislation have kept non-residential investment strong during a period when residential investment as well as current manufacturing production were very weak. Thus, investment in the non-residential sector has remained positive even in the face of very high interest rates. As these new manufacturing plants continue to be built, the prospects for the US manufacturing sector will tend to improve. At the same time, the fiscal acts have also kept the US construction sector as well as construction employment in expansion, even as the residential investment sector plunged into recession. As long as the new administration’s policies tend to keep this economic environment more or less unchanged, the US economy can continue to grow over the next several years. If that is not the case, then once we have the new policies implemented, we will assess the potential effects on economic growth.

Trusting energy prices to continue to behave in support of the Federal Reserve’s monetary policy objectives is not a sustainable (or even recommended) strategy.

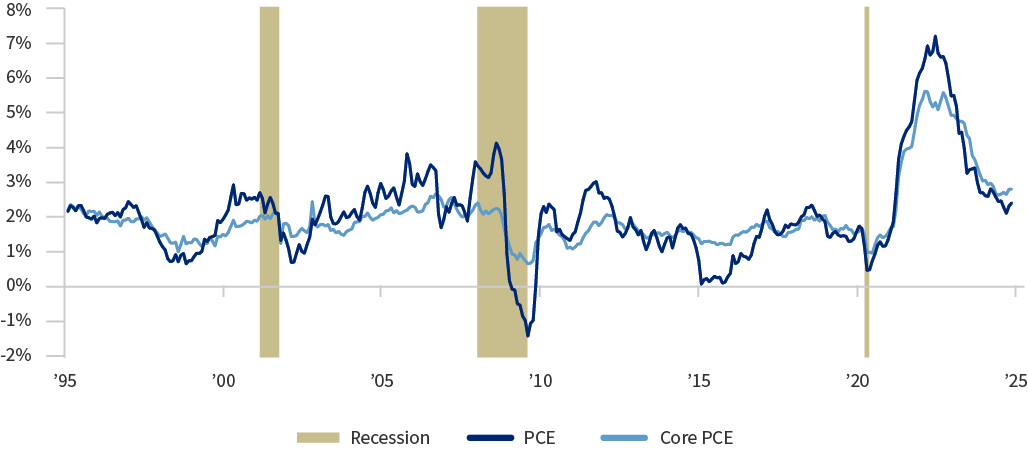

Strong growth during the last several years has not prevented inflation from decelerating after what happened in 2021 and 2022. The normalisation of supply chains, the drawdown of excess savings over time together with the ‘revenge spending’ triggered by the end of the pandemic, as well as the Federal Reserve’s (Fed) high interest rate policies have allowed inflation, finally, to approach the Fed’s target of 2.0%. However, the path to the 2.0% target rate has been slower than Fed officials would have liked as shelter costs have continued to remain uncharacteristically strong during this period compared to the past. At the same time, Fed officials have been very lucky as energy prices have continued to support lower inflation. However, trusting energy prices to continue to behave in support of the Fed’s monetary policy objectives is not a sustainable (or even recommended) strategy.

Furthermore, although the headline PCE price index is the Fed’s target inflation measure, Fed officials would like to see some further weakening of core inflation. That is, it prefers to see the core PCE, the personal consumption expenditures price index excluding food and energy prices, sustainably closer or even below the 2.0% target so it has some wiggle room to deal with the headline rate of inflation moving up or down temporarily without affecting the core PCE rate of inflation. This is the part of the inflation fight the Fed has not been able to win yet. This stability in the core PCE rate of inflation is a much longer-term objective, but one without which the Fed cannot be successful.

Today, the Fed has to deal with the potentially inflationary consequences of the incoming administration’s policies, especially regarding tariffs as well as deportation of illegal aliens. Although there are still unknown details such as the depth, extent, and application of such policies, an analysis of the economic consequences points to potentially higher inflation going forward. As we have said in the past, it is not that we believe we will have higher inflation going forward—however, if there is the potential for inflation to move higher in the future, this will trigger a change in Fed monetary policy, which could include interest rates staying high for longer or even pushing the Fed to increase rates if the inflationary consequences of these new policies merit such a move.

We have left interest rates for last because economic growth as well as inflation will determine the path of interest rates. This has been confirmed by markets, which are now expecting high interest rates to stay with us for a longer period of time. And we agree with markets at this junction. For now, elevated interest rates have not been a constraint on economic growth. High interest rates have not been binding for real non-residential investment while they have been binding for real residential investment. However, as the effects of the fiscal expansion created by the CHIPS and IRA, and to a lesser extent, the Infrastructure Act, continue to fade away, interest rates are going to become a constraint on economic growth.

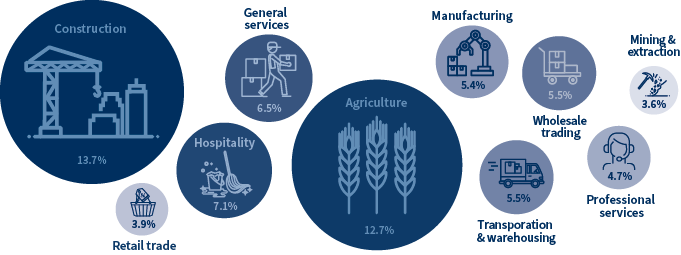

But perhaps the biggest risks for the US economy are higher interest rates from potentially higher inflation due to tariffs and the proposed deportation of millions of illegal migrants. While the impact on inflation from the curtailment of illegal immigration is going to take some time to feed into wages across the different industries affected, i.e., construction, agriculture, hospitality, etc., and then into inflation, the effects of the imposition of tariffs on imports from the rest of the world is going to have an almost immediate impact.

We could even start seeing some of the impacts from tariffs during the fourth quarter of last year and the first quarter of this year, not through higher inflation but through higher imports as firms try to front load any increase in future tariffs by replenishing inventories ahead of the increase in price. These added imports could weaken economic growth somewhat in Q4 2024 and Q1 2025 compared to a no-tariff environment.

The biggest risks for the US economy are higher interest rates from potentially higher inflation due to tariffs and the proposed deportation of millions of illegal migrants.

Once again, we want to be mindful of the few details available regarding the implementation, breadth, and scope of the potential tariffs—our analysis is just an interpretation of publicly available information. You can also read our fourth quarter 2024 Investment Strategy Quarterly article in which we covered this topic in some more detail.

But the fact of the matter is that the imposition of tariffs on imports will increase the price of those goods that are covered by the tariffs as well as generate an increase in the prices of domestically produced goods that compete with the imported goods that are covered by tariffs. At the same time, tariffs will increase the price of inputs used in production and these increases in the cost of production will find their way into the final price to consumers. Higher inflation will push the Fed to keep interest rates higher for longer and/or increase interest rates further.

All this means that today’s interest rate path is higher than it was before the results of the presidential election. Fundamentally, this is because the prospects for economic growth today have improved marginally but primarily because the prospects for higher inflation have changed materially, which will keep the Fed in a defensive position. At the same time, this new interest rate path may increase the risks of a recession down the road, especially if the effects of the new policies increase the rate of inflation more than markets expect.

Once again, and going back to the title of this article, while the November 5th presidential and congressional elections cleared the path of one set of uncertainties, it also added another completely different set of uncertainties that markets, investors, and economists, will have to deal with going forward to figure out the path for economic growth, inflation, and interest rates during the next several years.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this article is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this article should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this article have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this article please contact your wealth manager.

APPROVED FOR CLIENT USE