Key Takeaways

Recent weeks have seen immediate pandemic concerns in the U.K. moderate, but patently the backdrop is far from easy.

U.K. risk assets are as bound up with global events as they are with domestic-driven realities.

Expect the maintenance of an extremely loose monetary policy backdrop.

‘‘Let not your mind run on what you lack as much as on what you have already”

Marcus Aurelius

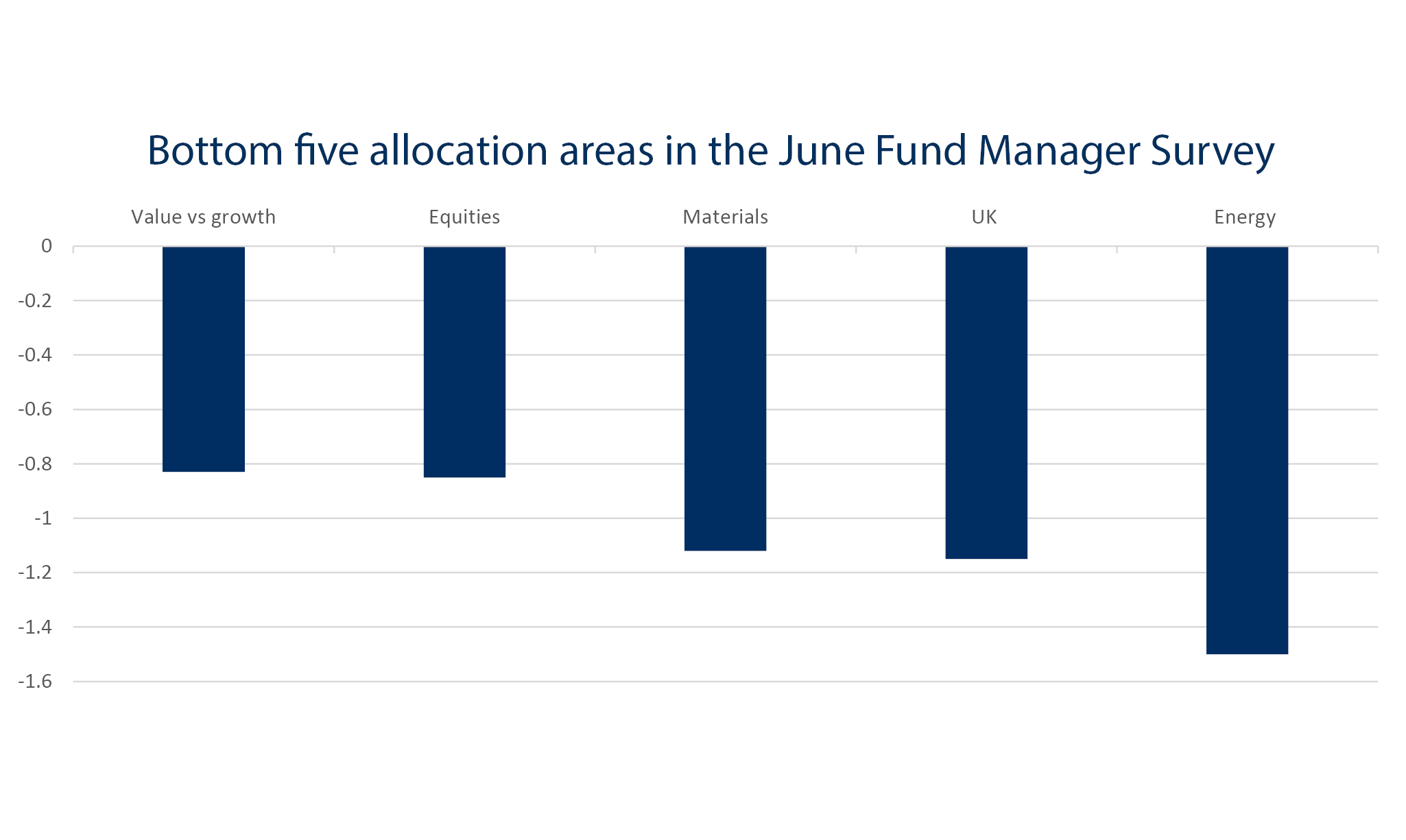

The latest regular survey of global money managers published in mid-June highlighted that a majority of respondents were still very cautious about the future for all the reasons cited above. And judging by material underweight holding in U.K. equities versus benchmark by the average global investor, concern about our own country runs deep. Undoubtedly, this will be partially influenced by the terribly sad aggregate pandemic cases and death rates, but it is also influenced by other matters that more typically impact financial markets. After all, recent disclosures about U.K. GDP has suggested an annual decline for 2020 at levels not seen in over three hundred years. Meanwhile, borrowing levels are at proportions of national output last hit in the couple of decades after World War Two. As for the Brexit debate, the legislative deal struck in January feels a long time ago and precious little progress has been made on the required detailed trade deal.

Such caution and pessimism does not sit well with a normally positive default position towards both human progress and human ingenuity over time. Certainly, the undeniably fallible human race can surprisingly easily get caught up in a short-term cycle of uncertainty and despair. Financial markets are similarly swayed over shorter time periods by such psychological and behavioural traits, hence the volatility of the first half of the year and the underperformance of U.K. equity assets, as well as a lacklustre time for the pound.

There is little doubt that U.K. risk assets are as bound up with global events as they are with domestic-driven realities. The U.K. is an open economy highly influenced by the level of global commerce and travel. Meanwhile, the composition of the larger capitalisation elements of the U.K. equity market is from a sector basis biased towards global earners of both a cyclical and more defensive nature. Exposure to the technological sub-sector areas which have enthused many global investors recently is more modest. Overall, this makes the U.K. economy, equity market and – by extension – the Pound geared towards any general global and domestic recovery. Progress seen in both East Asia and the Eurozone over recent months in controlling the impact of the first pandemic wave and hence allowing a broader restarting of economies, will help.

However, this needs to be supplemented by some heavy lifting domestically, beyond the use of the Bank of England’s balance sheet and the government’s budget deficit. It is probably a good sign that the senior officers of the Bank of England have recently stepped away from the notion of negative interest rates. For the future credibility of monetary policy, this is a positive step as negative interest rates are no panacea, as reflected by the recent experience of the Bank of Japan and the European Central Bank. Despite some 2020 outlook forecasting improvements from the U.K.’s central bank, the negative economic impact still anticipated in this year will dwarf anything seen in recent generations in speed and magnitude, and will not be fully offset in 2021. This is why the maintenance of an extremely loose monetary policy backdrop will persist deeper into the 2020s.

Fixed income markets are being remarkably acquiescent of the big build up in fiscal deficits to fund wage support schemes and other government spending initiatives. Partially, this reflects heightened quantitative easing purchasing by the Bank of England, as well as negligible immediate inflationary threats and naturally muted multi-year economic growth levels. However such an easy absorbing of material deficits cannot be taken for granted.

And this is where encouraging innovative thinking comes in, akin to the Prime Minister’s recent assertion to ‘build, build, build’. The key to a sustainable recovery outside of confidence in the health backdrop, is centred on encouraging everyone in the economy to think pragmatically and from an entrepreneurial perspective. Forget what has gone, think more about what you can do. Specifically in the U.K. there were hints after the last election of a bunch of ‘one nation’ reforms which have disappeared off the airwaves for obvious reasons in the last few months. It is essential to see initiatives like this – cutting across individuals and companies alike – coming back to fill the void that the inevitable tapering of wage and business support schemes will induce.

And finally, one of the biggest contributions to achieving such a backdrop over the next few quarters is avoiding a messy Brexit trade deal finale. Brexit retains its politically provocative capabilities but, shorter-term, avoiding additional economic growth challenges is a must. Expect a series of compromises here during the second half of the year, and a broader realisation that simple geographic proximity and ongoing inherently high trade links is reality.

Plenty of challenges await but some common sense at both the healthcare and economic policy level will mean that U.K. risk assets – especially equities and the Pound – will provide opportunities for investors in the second half of the year and beyond, hopefully at substantially lower levels of volatility than seen in the first six months of the year.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE