ISQ - January 2023

Key Takeaways

Emerging markets enjoyed a golden age during the first decade of the century, but this dissipated as headwinds built up.

The COVID pandemic has added to challenges, raising concerns from population vulnerability to weakening fiscal positions and austerity measures augmented by elevated inflationary pressures and sharply higher interest rates.

China’s “zero COVID” policy and the ongoing conflict in Ukraine have added to the uncertainty posed by the global economic slowdown and put a brake on a broad-based revival in investor appetite.

A shallow and short global recession, coupled with ebbing inflationary pressures and an easier monetary outlook as 2023 progresses, should underpin a revival in investor interest.

The outlook for emerging market government bonds and dollar-denominated sovereign debt should brighten as 2023 progresses, while the outlook for equity markets will become increasingly positive as the global economy revives. Latin America and India look appealing for longer-term investors.

The outlook for emerging markets is likely to improve in 2023 and 2024, but a return to the “golden age” of prosperity that characterised the period from 2000 to 2016 is less assured.

Typically, the definition of what constitutes an emerging market (or economy) coalesces around the assumption that it is steadily transitioning into a developed economy or market whilst benefiting from rapid growth in economic output, rising per capita income, increasingly liquid and investable financial markets underpinned by sufficient liquidity to limit overly sharp fluctuations in both currencies and financial asset prices. Emerging economies differ from their typically smaller and less established frontier equivalents, where investment returns can be greater but with markedly higher levels of inherent risk and illiquidity.

Driven in no small measure by the popularisation of the term BRICS (Brazil, Russia, India, China and South Africa), the emerging universe enjoyed something of a golden age during the first decade of the new century. Emerging economies accounted for around two-thirds of total global growth between 2000 and 2015, according to the World Bank, prompting many to envisage an “EM century” in which the rapid growth trajectory persisted and per capita incomes converged steadily with those of the developed world.

What has transpired in the period post-2015 is the realisation that the fast-paced growth of the 2000s was an exception, not the norm, owing less to a lasting acceleration in economic performance and more to one-off factors associated with the adoption of market-friendly economic liberalisation, lowered trade barriers and economic reforms aimed at stabilising fiscal positions and bringing periodic bouts of aggressive inflationary pressure under control. Technology’s spread and adoption facilitated rapid integration both with other emerging economies and the developed world more generally. The result was a surge in productivity that produced the one-off out-peformance at the start of the century.

But the boost to productivity faded as the previous step gains dissipated; economies can only open up once! Simultaneously, new headwinds began to build up. Working-age populations in most emerging markets were rising, but the growth rate was slowing, ultimately weighing on productivity. More fundamentally, productivity growth began to ebb as structural issues building in the 2000s began to bite. In the case of China, the problem became one of over-investment and a steady increase in excess capacity, while Brazil and Russia suffered from the opposite problem, crumbling infrastructure and chronic underinvestment.

The COVID pandemic has served to add to the challenges faced by emerging markets. Whereas most developed economies have broadly returned to pre-virus levels of activity, the recovery across many emerging markets has taken longer. Vaccine rollout has been slower, and populations are still vulnerable to possible future outbreaks. Fiscal positions have weakened, forcing the imposition of austerity measures which, when exacerbated by inflationary pressures and sharply higher interest rates, has depressed household incomes and crimped business investment.

Meanwhile, the pandemic’s after-effects have served to reinforce policy-related challenges weighing on growth even before COVID struck. Most notably, this has manifested in elevated levels of antagonism between China and the West. President Biden and his counterpart President Xi certainly seemed to emphasise the importance of mutual economic cooperation and respect at the recent G-20 Summit. However, the recently reinstalled Chinese leader seems intent on pursuing state, rather than market-driven, evolution. How the relationship between the U.S. and China evolves will likely matter a lot to investors as 2023 unfolds.

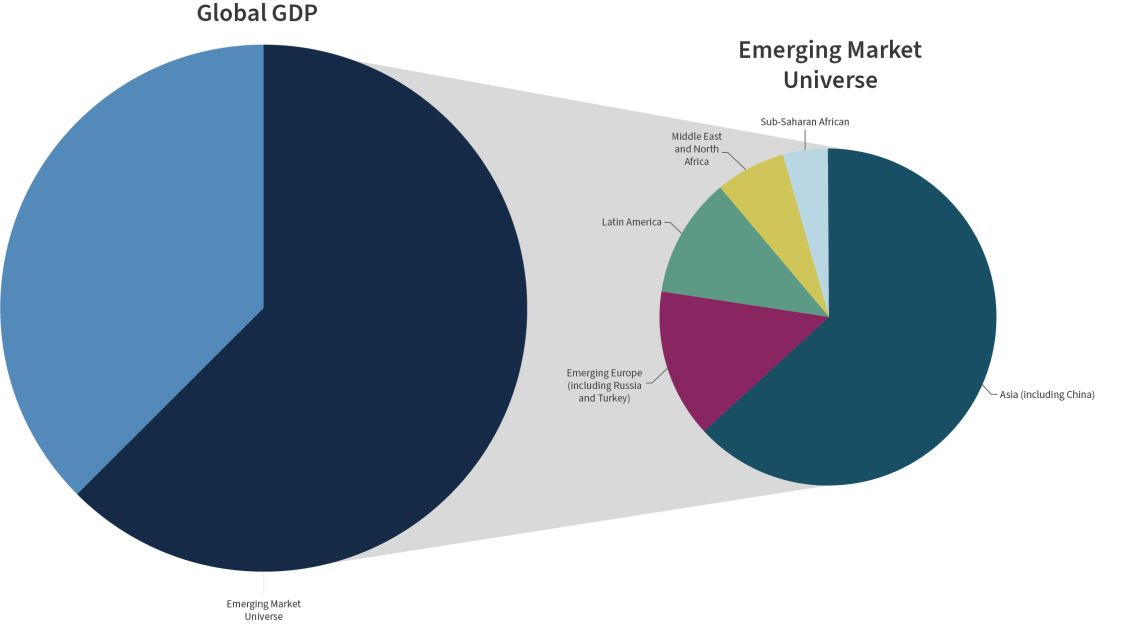

According to data supplied by the World Bank and International Monetary Fund, the emerging universe accounts for 62.5% of global GDP, of which the lion’s share is accounted for by emerging Asia (including China) at 36.7%. Emerging Europe (including Russia and Turkey) accounts for a further 8.3%, followed by Latin America (6.7%), the Middle East and North Africa (3.9%) and Sub-Saharan Africa (2.5%) > see Chart 1 – Emerging Market Universe above. All regions were adversely affected by the COVID pandemic but to varying degrees. Latin America fared worst, with regional GDP plunging by 6.8% in 2020, while emerging Asia performed more strongly as regional GDP fell by just 1.7%. The universe enjoyed a “post-COVID” rebound in 2021 from -2.5% the previous year to +7.1%, with Latin America’s commodity boom proving the standout feature. Although emerging Asia rebounded strongly in 2021, the enforcement of an aggressive “zero COVID” policy in China has put a severe dent in 2022 and prospects for 2023.

Inflationary pressure, as measured by headline consumer price indices, was never as subdued across the emerging market universe as in developed economy counterparts over the past decade. However, it is thought likely to have surged from 3.8% in 2021 to 6.5% in 2022. Encouragingly, pressures are dissipating, signalling a likely reversal of the monetary policy tightening process characterising most markets over the past year or so. Several central banks in Latin America and Emerging Europe have signalled that the rate hiking process is likely over, while those in Asia may have a little further to go. In turn, this implies that rate cuts are likely to prove a feature of the emerging market investing landscape in 2023, led by Latin America, the consequence of lower commodity prices.

The combination of ebbing inflationary pressures and easing central bank policy should prove a constructive backdrop for local currency government bonds. Yields on 10-year benchmark sovereign bonds are already on a downward path, particularly so in Emerging Europe. Whilst the continuing war in Ukraine casts a long shadow, investor confidence in the region, excluding Russia, has revived as natural gas prices have subsided from their late summer peak. The standout exception to this broadly positive trend is Brazil, where bond yields have risen on concerns that the recent election might result in increased fiscal spending. One limiting factor likely to impact in the very near term is a broad-based diminution in risk appetite as the global economy slips into recession.

More encouragingly, that recession is thought likely to be shorter and shallower than the pandemic-induced collapse of 2020 and the Great Financial Crisis period. Yields should start declining on a more sustained basis from mid-2023 onwards as the global economy revives, inflationary pressures diminish, and central banks cut rates.

A similar trajectory is likely across dollar-denominated emerging market bonds. Yields have dropped sharply since late October, reflecting narrowing yield differentials and notably lower “risk-free” yields as rate hike expectations in the U.S. pared back. That this has taken place at the same time as the rally in share prices provides strong evidence that the improvement has been built on a revival in investor risk appetite. Again, the near-term sustainability of this rally is open to question as the global economy weakens, but as above, sentiment should improve as 2023 progresses, and yields should fall further in 2024.

Emerging market equities have enjoyed a strong revival over the autumn, the MSCI Emerging Markets Index exceeding the performance of the MSCI World Index of developed market equities by a comfortable margin, albeit that indices are still well below levels they started the year. Overall performance masks significant regional divergence, with emerging Asian equities performing strongly, boosted by speculation regarding a possible easing in China’s draconian “zero-COVID” policies, while emerging Europe, Middle East, Africa and Latin America have proved much more subdued.

Concerns regarding the near-term health of the global economy and its adverse impact on corporate earnings may weigh on investor appetite as the New Year commences, even excluding uncertainty surrounding China and the duration of military conflict in Ukraine, but sentiment and performance should stage a steady improvement with key benchmarks ending 2023 above prevailing levels with further gains likely in 2024 led by Latin America and India.

*An affiliate of Raymond James & Associates, Inc., and Raymond James Financial Services, Inc.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE